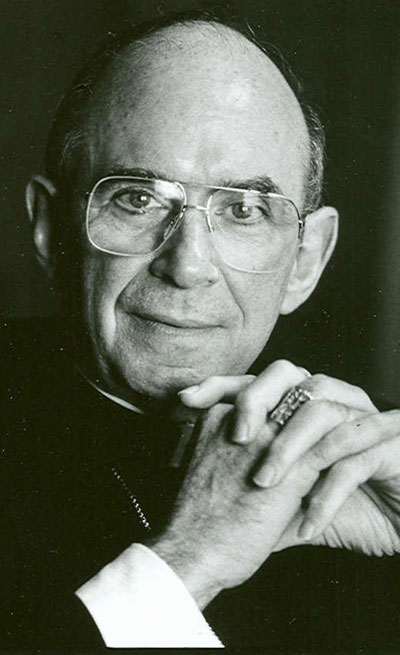

The Joseph Society

The Joseph Society is named in honor of the late Joseph Cardinal Bernardin who inspired the founders of the Big Shoulders Fund. The society is comprised of supporters who have made a special commitment, through a planned gift, to the children attending Big Shoulders Fund schools in the most challenged areas of inner-city Chicago. We'd love to welcome YOU as our newest member!